BBM Retirement Fund No.1, an Australian unlisted property fund managed by BBM Capital Management Pty Ltd, has agreed terms to invest in DD Resort Living Pty Ltd (“DDRL”), a specialist development group focused on social infrastructure developments by delivering premium vertical low-care and supported retirement living communities along Australia’s East Coast.

Please note: All images shown on this page and throughout the website are artist impression renderings only.

Equity Target

AUD$320M

Term of Fund

10 Years

Target IRR

Above 25%

Minimum investment

AUD$50M

Fund at a glance

Key Features

-

Acquisition and development of premium, vertical, retirement living communities

-

Backed by one of Australia’s most experienced residential property developers

-

Build–Own–Operate model that retains the ownership of the real property assets

-

Retirement living is one of the fastest growing sectors of the Australian economy

The Fund is seeking to raise AUD$320 million.

The Fund’s investment in DDRL has been structured as follows:

-

the Fund will hold 25% of the issued shares in DDRL.

-

the Fund will lend AUD$10.5 million to DDRL to assist with funding fees and expenses

(including equity raising fees payable to BBM).

-

the Fund will lend AUD$289.5 million to the Project entities undertaking the development

of the retirement village assets.

-

the Trustee will hold $20 million to fund fees and costs associated with the operation

of the Trust (including fees payable to the Fund Manager.)

The investment structure provides an initial coupon return of 7% per annum of the borrowed funds (accrued), with the principal being repaid in priority to the payment of dividends to the shareholders of DDRL. The Fund’s shareholding in DDRL then provides the Fund with an ongoing income stream from the operation of the retirement village properties.

The investment is designed to deliver strong returns, with initial capital projected to be returned

in Year-4 and a targeted internal rate of return over 25% by 2035.

DD Resort Living Pty Ltd

DD Resort Living Pty Ltd (DDRL) is led by a high-calibre executive team dedicated to delivering world-class retirement communities that seamlessly integrate luxury, wellness, and lifestyle. At the helm is Executive Chairman David Devine, a renowned property developer with decades of experience. Greg Roberts, Operations Director, ensures resident wellbeing through his deep expertise in aged care and retirement services.

In addition to this visionary leadership DDRL is supported by a broader team of seasoned professionals whose depth of experience spans property development, financial management, legal governance and strategic marketing. This leadership team is united by a shared commitment to redefining retirement living—creating vibrant, wellness focused communities that support longevity, independence and connection. Their whole-of-business approach ensures seamless delivery from development to operations with every project designed to elevate the retirement experience.

Investment Term

The Fund is forecast to be a 10-year investment vehicle, with a number of exit strategies identified.

The Fund’s objective is to provide return of equity for investors at the end of the Year 4 (subject to performance of each Project and repayment of the Fund’s loans). BBM will have a director appointed to the Board of DDRL and the Investment Committee to provide oversight and oversee the operation of DDRL.

The Fund will also engage a Project Manager to monitor the performance of each Project. The current investment opportunity commenced in September 2025 and is scheduled to conclude in September 2035.

Exit Strategy

The Fund is considered illiquid, as there is no established secondary market or other redemption facility for Units in the Fund. An investment in the Fund should be considered a long-term investment.

Exit planning is flexible and guided by prevailing market conditions, performance milestones, and investor preferences. The Fund’s exit

event are expected to be linked with a broader exit event for DDRL,

which may include:

-

Initial Public Offering (IPO),

-

Trade sale,

-

Asset-by-asset sale, or

-

Refinancing and hold strategy

If BBM elects to exit its investment in DDRL prior to a broader DDRL exit event, then any disposal of its shares in DDRL will be subject to the terms of the Shareholders Agreement, which may require the shares are first offered to the other shareholders in DDRL before they can be offered to a third party

Investment Highlights

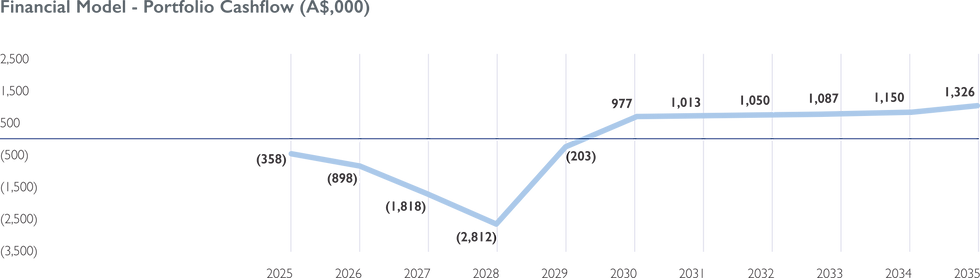

An investment in the Fund presents a unique opportunity to acquire a 25% equity stake in a transformative social infrastructure development, supported by AUD$320M of funding which is projected to deliver AUD$1.85B in total returns over a 10-year investment horizon, equating to a projected IRR of 25.1%. The project enters a development and construction phase from mid-late 2025 to 2028, with no distributions forecast during this period. From 2029 onwards, the asset is projected to become cash-generative, delivering distributions through to 2034, with a planned exit in 2035. This investment opportunity offers institutional investors and ultra-high net wealth investors a compelling long-term growth profile.

Financial Highlights

Between 2025 and 2028, the retirement village portfolio undergo their capital deployment phases, with total development costs of approximately AUD$3.1 billion. No further funding or capital outlay is expected from shareholders in DDRL beyond 2028. From 2029, diversified cash flows are projected to commence, including AUD$3.4 billion in ILU/apartment sales, AUD$659 million in up-front management fees, and AUD$34.7 million in deferred management fees (based on industry averages). Additional income includes AUD$60 million in retail rent, AUD$184 million in interest on regulatory reserves, and AUD$82 million in net capital gains. By 2035, cumulative net cash flow are projected to reach AUD$1.33 billion.

Note: the financial feasibility for DDRL project the Fund’s loans to DDRL and each Project entity are forecast for be repaid in year 4, funded from the proceeds from the leasing (‘sales’) of ILUs/apartments (under a loan-to-lease scheme) at which time DDRL’s portfolio of properties are projected to be debt free and ungeared. This financial feasibility is based on a number of assumptions, including construction program, construction costs, sales prices and sales rates. Accordingly, the actual date of the repayment of the Fund’s loans to DDRL and each Project entity (and therefore the Fund’s ability to return capital to investors) is subject to change.

DDRL Property Portfolio Highlights

5 assets

7 Towers

1,192

Independent Living Units

(ILU)

A$3.1B*

Development Cost

A$6.9B*

Terminal Value

* The total terminal value of DDRL’s share of the portfolio.

All financial and forecast information are based on preliminary calculations and estimates.

Important Notice

An investment in the Fund is restricted to persons that qualify as wholesale clients, sophisticated investors or professional investors (as defined in the Corporations Act). Details of the Fund and its proposed investment activities are outlined in an Information Memorandum for the Fund. Prospective investors are required to complete a Subscription Deed to invest in the Fund.

All information regarding the Fund on this website is general information only and does not take into account the objectives, financial situation or needs of any particular person. Accordingly, persons accessing information regarding the Fund on this website should consider the appropriateness of the information having regard to their own objectives, financial situation and needs; and consult their financial adviser before making any investment decisions.

An investment in the Fund is subject to risks associated with lending and the ownership and development of retirement village properties (and associated assets). Details of the risks are outlined in the Information Memorandum for the Fund.

The information regarding the Fund on this website contains forward-looking statements relating to future matters which are subject to known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of the Fund (and DDRL and each Project) to be materially different from those expressed or implied by such statements. Forward-looking statements are not guarantees of future performance. No person, company or entity makes any promise or representation or gives any guarantee as to the performance or success of the Fund, the repayment of capital or any particular rate of income or capital return for the Fund. Actual returns of the Fund may differ from those forecast or projected.

All images on this website are not assets of the Fund or DDRL and are merely indicative of the type of development DDRL is intending to complete.

Except as required by law, no representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of the information, opinions and conclusions, or as to the reasonableness of any assumption, contained in this website. To the extent permitted by law, BBM and its associates, and any of their respective directors, officers, employees, representatives or advisers are released from any liability (including, without limitation, in respect of direct, indirect or consequential loss or damage arising by negligence or default) in relation to any anything contained in, or omitted from, this document.